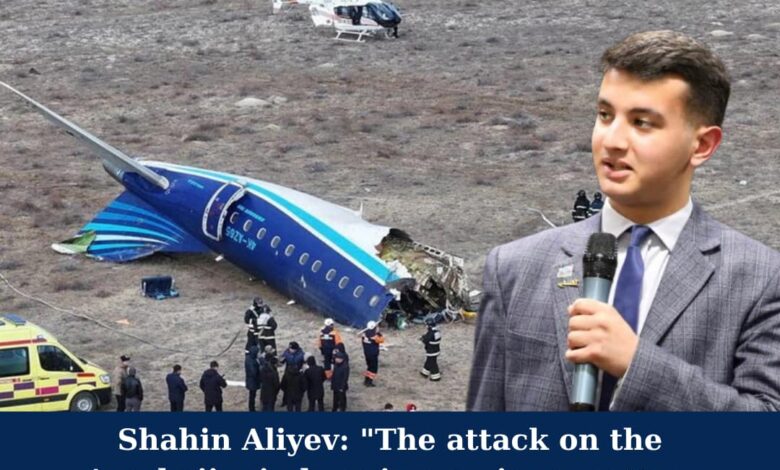

Chairman of the “Eternal Union” Youth Public Union and a young Azerbaijani politician, Shahin Aliyev says: “The attack on the Azerbaijani plane is a serious matter; Russia must apologize, and those responsible must be held accountable”

According to preliminary reports, a passenger plane belonging to “Azerbaijan Airlines” on the Baku-Grozny route was attacked by Russia’s “Pantsir-S” air defense system as it approached the city of Grozny. This incident has caused significant concern, and the relevant Azerbaijani authorities have launched an investigation.

Commenting on the issue, Shahin Aliyev, Chairman of the “Eternal Union” Youth Public Union and a young Azerbaijani politician, condemned the incident and emphasized Russia’s responsibility:

“The attack on a civilian plane belonging to the Republic of Azerbaijan is a violation of the fundamental principles of international law and undermines the spirit of cooperation between the two countries. The possibility that this incident was deliberate must be thoroughly investigated. Azerbaijan has the right to demand an explanation and an official apology from Russia. Furthermore, those responsible for this reckless act must be immediately punished. Internationally recognized safety protocols must be upheld to prevent such incidents from recurring.”

Shahin Aliyev stressed that the safety of Azerbaijani citizens is always a top priority and highlighted the importance of constructive steps by Russia to address the issue.