Anglo African is a privately-owned technology group based in Mauritius with growing international interests, including in Djibouti, Zambia and India. We have now issued three integrated reports, the latest being for the year ended 30 June 2017. The trigger for adopting integrated reporting <IR> came in 2014, when we were thinking about going for a stock market listing. Because we are in the technology space, our chairman at the time suggested we embrace innovation in our reporting too. So we adopted <IR>, even though we didn’t in the end decide to list at that time.  ase

ase

What critical challenges did you face?

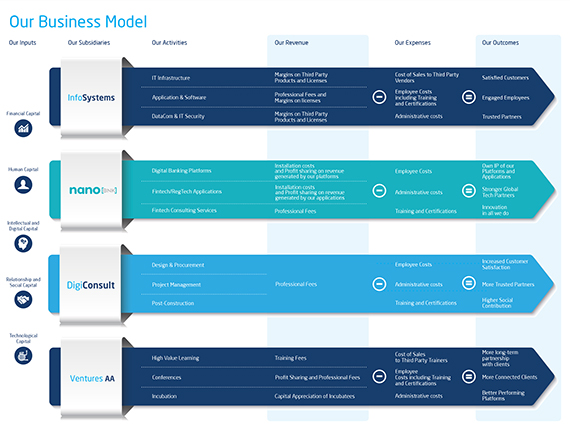

Our chairman and board understood the value in integrated reporting. As the then CEO I personally took charge of it. Being a small group, we took a simple approach and didn’t implement the full <IR> Framework in one go. We started with the capitals and we also focused on two principles: conciseness and understandability. We looked at what other companies had done: there was a lot of boilerplate reporting, but we thought the reporting by some of the South African banks was good. From this we decided to give a high priority to the graphical side of our reporting: we spent a lot of time transforming text into graphics.

In the second year we met more challenges – because in the first year we explained our strategy, and then in the second year we had to explain how we performed against that strategy. You have to explain the deviations and the connectivity. This is when our integrated thinking really started.

The main challenge overall that we have faced in our integrated reporting is around connectivity. It was only in our third integrated report that we achieved a good level of connectivity between all items. We found we needed to customise the International <IR> Framework capitals to make sure everything was flowing. We have identified five capitals relevant to us: Relationship & Social, Human, Financial, Technological and Intellectual & Digital.

Once we had customised the capitals and improved connectivity, integrated thinking also became our strategic planning – now in everything we do, we take it to the “Capitals” drawing board.

What changes has integrated reporting brought the business?

Integrated thinking and reporting has changed our group strategy. For example, we decided to terminate a business focused on traditional IT businesses or devices – we terminated the business despite the fact that it was profitable and started focusing on emerging technologies such as artificial intelligence (AI), blockchain, Industrial Internet of Things (IIOT) and others. The traditional IT devices sector has far lower multiples (price-earnings ratios) than emerging technology businesses. It was difficult from a personal perspective to abandon a business that we had started and was trading profitably – and also hard to communicate that to our stakeholders. However, emerging tech is more aligned to the vision we have for Anglo African: to become the most valuable technology firm in the markets where we operate.

We are now doing well: this year our profits are stable but the projections for the coming years look promising. Our teams are designing proprietary software which is enabling us to develop our own intellectual property and we can engage in more exclusive technology spaces. Since our last integrated report was published six months ago we’ve already moved on: we are live in Cameroon and we’re working on launching operations in Asia as well. Constant change is now embedded in the culture of our organisation.

Any competitive disadvantages from adopting integrated reporting?

From an entrepreneurial viewpoint, when adopting <IR> we were a bit wary at first about confidentiality: small businesses can be a bit overprotective about what they are doing. But the speed at which entrepreneurial businesses move is fast. So by the time you publish your report, you are already well ahead with implementing the strategies you decided on a year ago and it would be difficult for competitors to keep up.

We haven’t found any competitive disadvantage from adopting <IR> – in fact, the contrary. A partner in a Big 4 accountancy firm told us that they were using us as a case study for integrated thinking. We operate in a niche sector, but now we are known by people in other sectors and so have raised our profile but most importantly, it has brought a lot of credibility and trust to the organisation.

For example, a Singaporean businessman came to see us with a view to investing in one of our subsidiaries. We had prepared for a whole day of discussion, but in fact the meeting only lasted two hours: the businessman said everything was in our report and he only wanted some clarifications.

“Small businesses can be a bit overprotective about what they are doing. But the speed at which entrepreneurial businesses move is fast. Since our last integrated report was published six months ago we’ve already moved on. It would be difficult for competitors to keep up.”

Benefits?

The most important benefit we’ve seen is trust. As a start-up competing with businesses in operation for 50 years, you can’t expect trust initially. Integrated reporting has helped stakeholders to build trust in us because we are telling a convincing story, which they could compare year on year and also how the company was interacting with different stakeholders in its forward-looking strategy.

The second main benefit is internal. Adopting <IR> has put order into our thinking. Entrepreneurs see a lot of opportunities and most don’t end up where they intended to go. Integrated reporting provides discipline for high growth SMEs/start-ups: it is a way to ask whether an opportunity will be adding value. For me, <IR> is not a reporting tool; it’s a strategic planning tool.

Anglo African has adopted a rigorous process to identify the most relevant sustainable development goals (SDGs) for each of its subsidiaries, as well as for the group as a whole. Can you talk us through the process?

What we liked about SDGs was their immediate global adoption as all UN Member states signed up. We’re probably one of the first businesses to embed the UN’s sustainable development goals in our integrated report. We had a unique opportunity to merge the two together, because we’ve already got our customised capitals mix. For example, we already have our thinking process around human capitals, so it’s logical to add diversity as a dimension to that.

We would not have done the SDGs without the <IR> Framework. 17 goals and 169 targets – that’s not manageable for any entrepreneurial business; it’s difficult even for governments and large businesses to get their heads around!

We looked internally and externally to identify the ones that are most obvious for our business. We can assume these SDGs are important for us within our integrated reporting capital mix. In our 2017 integrated report we show our capitals mix and the SDGs separately. Next year they will come together in our reporting.

“You need to see value in doing it – if not, it’s not going to work. If I had to go and appoint consultants to prepare the integrated report, I think we would not have done it.”

What’s next?

We have so far customised the <IR> Framework for our industry, integrated part of the SDGs and have reached quite an advanced level of integrated thinking. The next step is about how we decentralise our <IR> framework. We have a few subsidiaries and are pushing the <IR> approach down into them. Our Fintech/Regtech subsidiary NanoBNK will have its own integrated report for the 2018 year end.

We try not to force the concept down people’s throats – they have to see the value of the integrated reporting process. They will have to go through their own learning experience, but they will get a lot of support. We are giving feedback about the capitals, for example. With our subsidiaries, it’s the integrated thinking that is leading the way, rather than the integrated reporting itself.

Any advice for other SMEs adopting integrated reporting?

You need to see value in doing it – if not, it’s not going to work. If I had to go and appoint consultants to prepare the integrated report, I think we would not have done it. For larger businesses it makes sense, but for entrepreneurial businesses it needs to be driven by the business leadership.

Regular involvement from the board is very important. You may do your strategic planning only once every two years, but with an integrated report you’re brainstorming your opportunities and risks throughout the year, so you’re putting strategy into question in real-time at each board meeting. With the <IR> Framework, we know the challenges that we face – some of them are quite fierce challenges – so now we’re more confident.

Read Anglo African’s latest integrated report

www.accaglobal.com